25+ arkansas wage calculator

A wage garnishment for defaulted student loans is limited to 15 of. Work out your adjusted.

Free Arkansas Payroll Calculator 2023 Ar Tax Rates Onpay

Employers may use this each pay period to calculate the Wage Garnishment Amount to be deducted from the debtors.

. Web Arkansas state tax 4000 Gross income 70000 Total income tax -12387 After-Tax Income 57613 Disclaimer. - A Annual salary HW LHD 52 weeks in a year - B Monthly salary A 12 - C. That means youll pay tax only on the first 10000 of each employees wages each year.

Web Calculating your Arkansas state income tax is similar to the steps we listed on our Federal paycheck calculator. The federal salary threshold is now 684 per week equivalent to 35568 per year for a full. Web The adjusted annual salary can be calculated as.

Web Use ADPs Arkansas Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Web 23 rows Living Wage Calculation for Arkansas. Figure out your filing status.

Web Administrative Wage Garnishment Calculator. 30 8 260 - 25 56400. Web In Arkansas tipped employees such as waitresses bartenders and busboys also have to factor their earned tips into their total wages as well as any tip credits claimed by their.

Web Use our calculator to discover the Arkansas Minimum Wage. Web Arkansas Salary Paycheck Calculator. Web The wage base in Arkansas is 10000.

Web Arkansas does not have a state salary threshold so the federal threshold is used. Just enter the wages tax withholdings and other. Web The second algorithm of this hourly wage calculator uses the following equations.

Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total. Calculations are estimates based on tax rates as of Dec. Youll need to pay the tax and file quarterly wage.

Web b 25 percent of disposable earnings after federal state and local taxes and retirement contributions. The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. The state charges a progressive income tax broken down into six tax.

Web Now that weve gone through federal payroll taxes lets look at Arkansas state income taxes. Calculate your Arkansas net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and. Web Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

The Arkansas Minimum Wage is the lowermost hourly rate that any employee in Arkansas can expect by law.

Tennessee Wage Calculator Minimum Wage Org

Arkansas Wage Calculator Minimum Wage Org

Aoq52vn7scaijm

A Closer Look At Oregon S Median Household Income A Closer Look At Oregon S Median Household Income Qualityinfo

Arkansas Salary Paycheck Calculator Gusto

Alabama Wage Calculator Minimum Wage Org

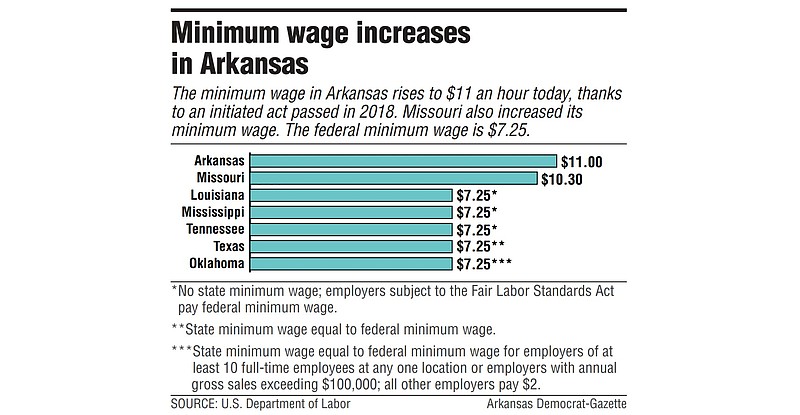

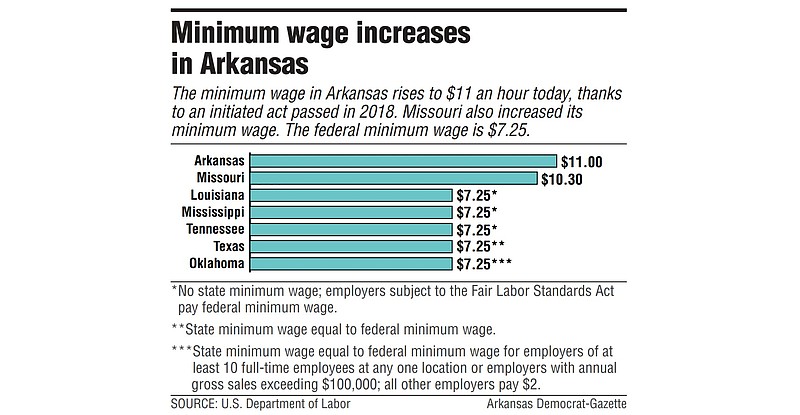

State Minimum Wage Climbs To 11 An Hour

Arkansas Paycheck Calculator Tax Year 2022

Arkansas Paycheck Calculator Smartasset

I Am A C Developer At A Multinational Company In Munich For 1 5 Years With A Basic 42000 Euro 4000 Euro Variable Bonus Pay Am I Earning Enough Quora

Has The Great Recession Raised U S Structural Unemployment In Imf Working Papers Volume 2011 Issue 105 2011

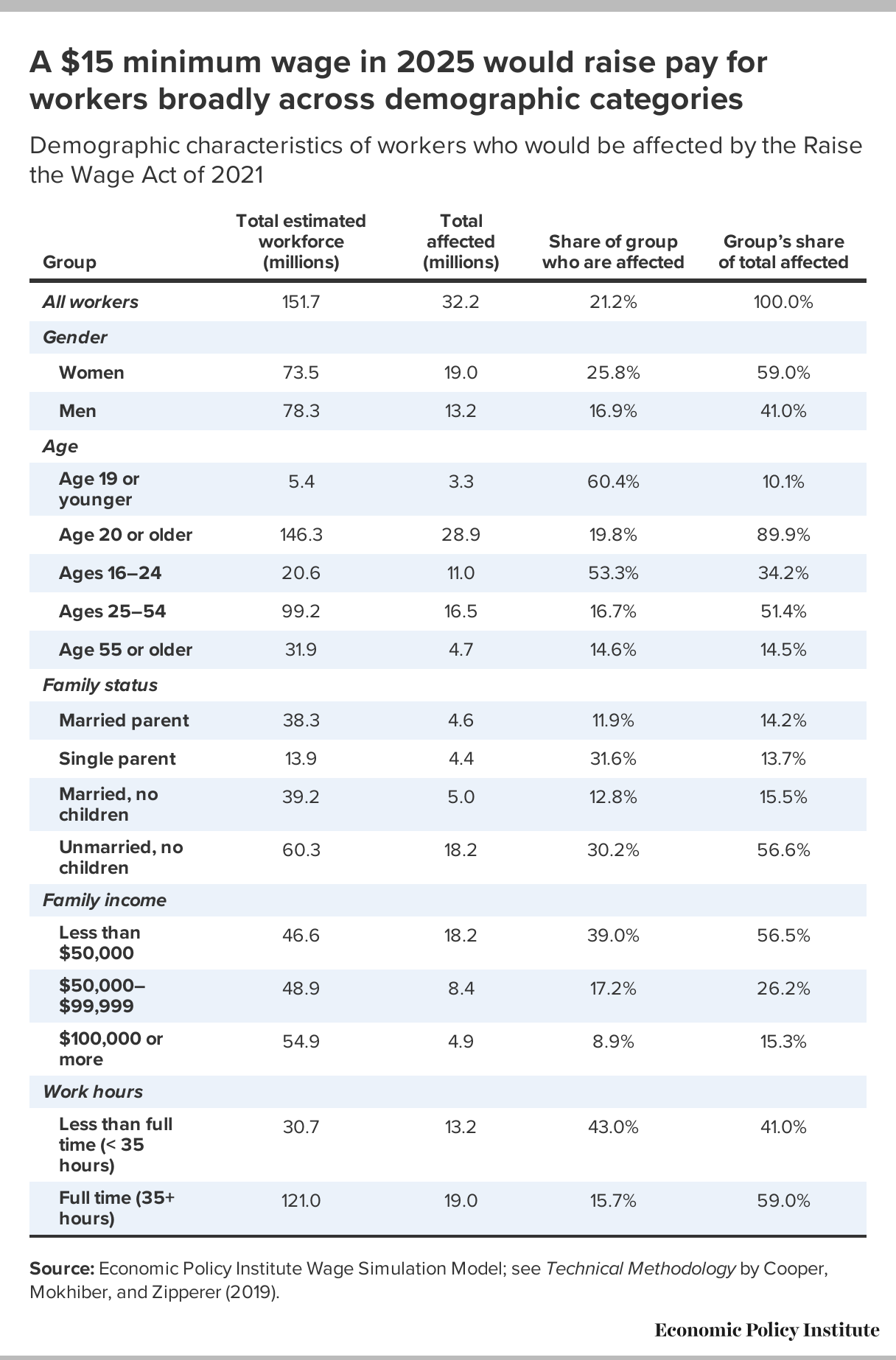

Raising The Federal Minimum Wage To 15 By 2025 Would Lift The Pay Of 32 Million Workers A Demographic Breakdown Of Affected Workers And The Impact On Poverty Wages And Inequality Economic Policy Institute

Free Paycheck Calculator Hourly Salary Usa 2023 Dremployee

Has The Great Recession Raised U S Structural Unemployment In Imf Working Papers Volume 2011 Issue 105 2011

Federal And Arkansas Paycheck Withholding Calculator

Bpd April 2022 By 526 Media Group Issuu

:max_bytes(150000):strip_icc()/Investopedia_Historyofcostofliving_colorv1-46383557fcda4f5a8e54f38e3096c4b8.png)

History Of The Cost Of Living